Renaissance Financial: Your Key to Smart Wealth Growth in 2023

Secure your financial future in 2023 with Renaissance Financial. Our investment experts provide tailored solutions to help you reach your financial goals.

If you keep an eye on emerging Instagram trends, you may have come across the term ‘Financial Renaissance’. Reportedly, it’ll be the most important search term for Gen Z (and probably the world) in 2023. But what exactly is the financial renaissance?

The basic concept behind the financial renaissance is to build wealth through lucrative side hustles, along with educating ourselves on investment strategies and diversifying portfolios. The idea has become more relevant today because of the upcoming recession, which is resulting in the downturn of the most traditional investments like real estate, stocks, and bonds.

For example, increasing interest rates and construction costs have resulted in a housing market recession, declining home sales by almost 20.2% as compared to 2021. Likewise, the stock market is heading for its biggest annual decline since 2008.

1. Diversify Your Assets

Asset diversification allows you to spread money among different investments to decrease risk. By choosing the right assets, you can limit your losses and decrease the fluctuations of returns without sacrificing potential gain.

However, the key is to choose the right group of investments, as it has a major impact on whether you’ll meet your financial objectives. For example, when the housing market is booming, flipping houses could work well for more short-term investments. However, purchasing and renting a property is a safer bet for long-term goals like retirement.

2. Include Enough Risk

You may also have to include enough risk in your portfolio in order to be able to earn a large enough return to meet your objective. For instance, when saving for a long-term goal, like college or retirement, you may include some dividends, index funds, and stock mutual funds in your portfolio, as they can help you get stable and moderate returns in the long run.

However, if you include excessive risk in your portfolio, you may not have the money when you need it. For example, a portfolio heavily weighted in stock or stock mutual funds would be unsuitable for a short-term goal, such as saving for a family vacation. Historically speaking, the biggest stock uptrends happen when the market is plummeting and it's extremely difficult to time the market. You have to be in the right place at the right time or perform dollar cost averaging (DCA) and plan for over a decade.

Source: Freepik

3. Seek Expert Advice

While you may find plenty of information and resources over the internet, remember that not all financial advice will work for everyone. Different people have different circumstances and goals. On top of that, there are ever-changing government rules and regulations.

It’s best to consult an expert who can suggest you the best financial planning strategy tailored to your unique circumstances. However, before you hand over your portfolio to an advisor, ask them what strategies they’ve formulated for other clients and what the circumstances were in those cases. This will help you gauge whether they offer cookie-cutter solutions or actually tailor advice specifically for each client.

4. Plan for the Future

It’s often quite difficult to look beyond the immediate social and economic events and concentrate on the end goal of long-term wealth creation. You may feel tempted to deviate from a long-term approach and chase quick returns. However, it’s more important than ever to focus on investing for the long haul while sticking to your game plan.

Growth stocks are perhaps the first thing that comes to mind when discussing long-term investment. However, it can be risky because often investors will pay a lot for the stock compared with the company’s earnings. Investing in real estate is another attractive strategy, but if you’re borrowing significant amounts of money from the bank, you’re putting extra stress on an investment turning out well. Even if you buy real estate with all cash, you’ll have a lot of money tied up in one asset, and that lack of diversification can create complications if the market falls and the trends are changing.

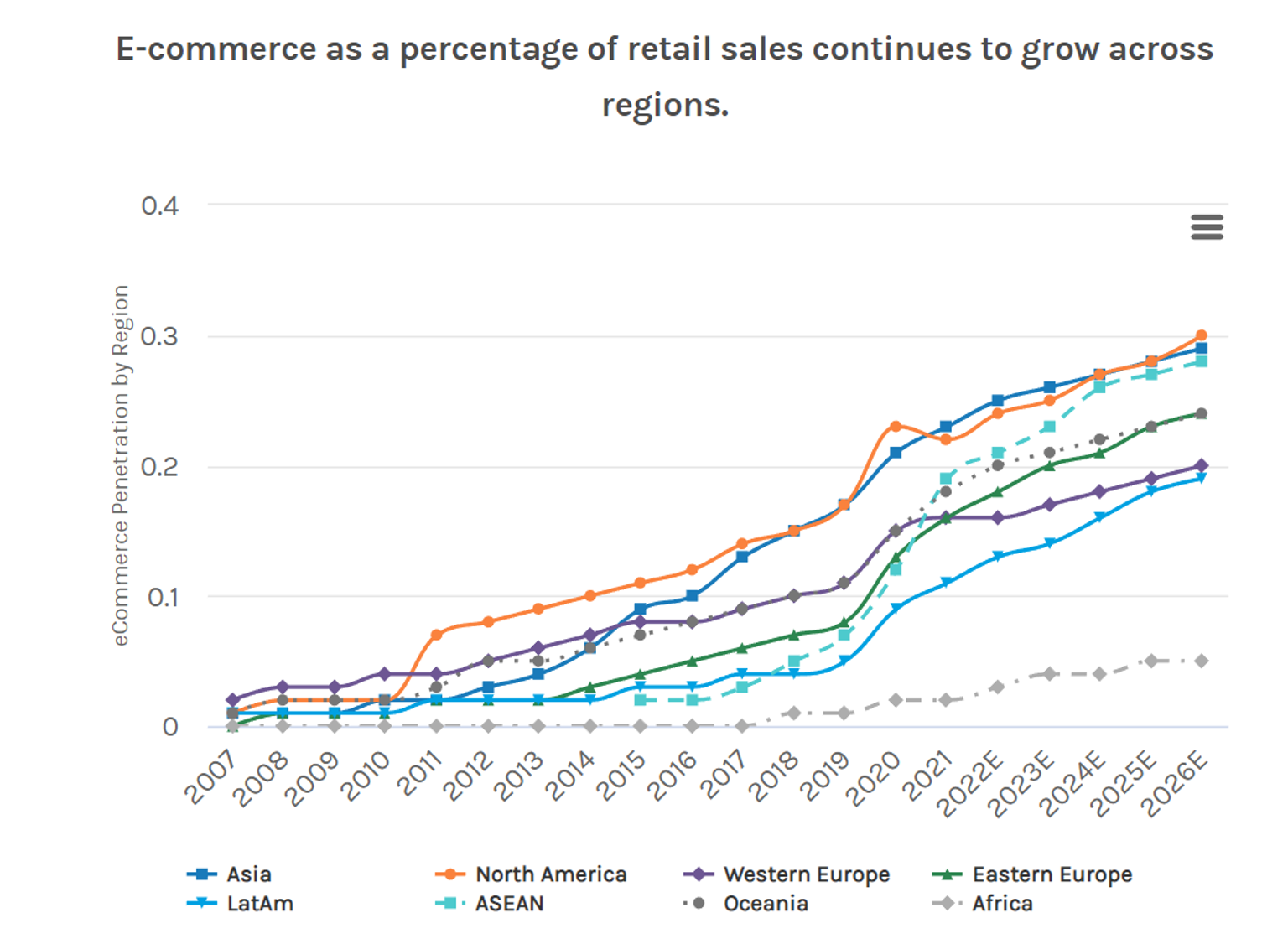

A smarter idea is to invest in eCommerce, which continues to show rapid development based on strong consumer spending and rapid technology growth. As many investors know, eCommerce has strengthened for several years, supported by mobile and internet penetration. Over the long term, the eCommerce market has plenty of room to grow and could increase from $3.3 trillion today to $5.4 trillion in 2026 with no sign of stopping.

Source: Morgan Stanley

Build a Stable Financial Future with eCommerce Automation

The easiest way to grow and scale your eCommerce business is through diversification of your sales channels. This means taking your products from where they are currently being sold (typically marketplaces like Amazon, eBay, and Walmart) and getting them accepted by big retailers and other platforms like Facebook and Shopify. With more eyes on your products, the sky is the limit to your success.

The best part about eCommerce automation is that it doesn’t require huge upfront capital investment like real estate, and it is not as volatile as stocks or bonds. Yet, you can diversify for different platforms. Compared to running your own business, you don’t have to do anything manually if you work with a dedicated eCommerce management service like AWM.

Whether you are just starting your eCommerce store or are looking to grow your existing one, diversifying your sales channels with AWM is the easiest way to expand your revenue potential without having to do all the legwork.

More channels mean more eyes on your products, resulting in more sales and profits!

Get in touch to learn more.