Role of Overhead Costs in Recession-Proof eCommerce Business!

This article will help you build a sustainable, recession-proof online business by taking some steps like reducing overhead costs & others.

According to a Bloomberg survey of economists, the probability of a recession occurring within the next year stands at 47.5%, which is up from 30% just a few months ago.

The recent economic shifts, uncertainties, and fluctuations in the stock market are showing clear signs of an impending recession in 2023. This will also affect eCommerce businesses and they might face decreasing sales and struggle to maintain performance during the financial slowdown.

1. Find the Right Product

The first step is to find the right products to sell online. You can’t sell anything if the market sentiment changes and people aren’t willing to buy excessive things. Many eCommerce sellers choose products that solve a customer’s pain point while others choose a niche based on their own interests.

The best recession-proof products are things that customers need in their everyday operations, such as food, clothing, healthcare, personal care, homeware, and pet items.

2. Set the Right Price

Product pricing is one of the keystone decisions you’ll make as an eCommerce seller. Today, customers are well-informed about their purchases and they’re sensitive to price because they want the maximum benefits for their money and time.

The right pricing strategies can improve profits and drive revenues faster than other growth levers. For every 1% improvement in the pricing, you can boost profits by 11.1%. During a low revenue period, optimize your pricing so that even when you’re facing slow sales, you can maintain positive margins.

3. Reduce Overhead Costs

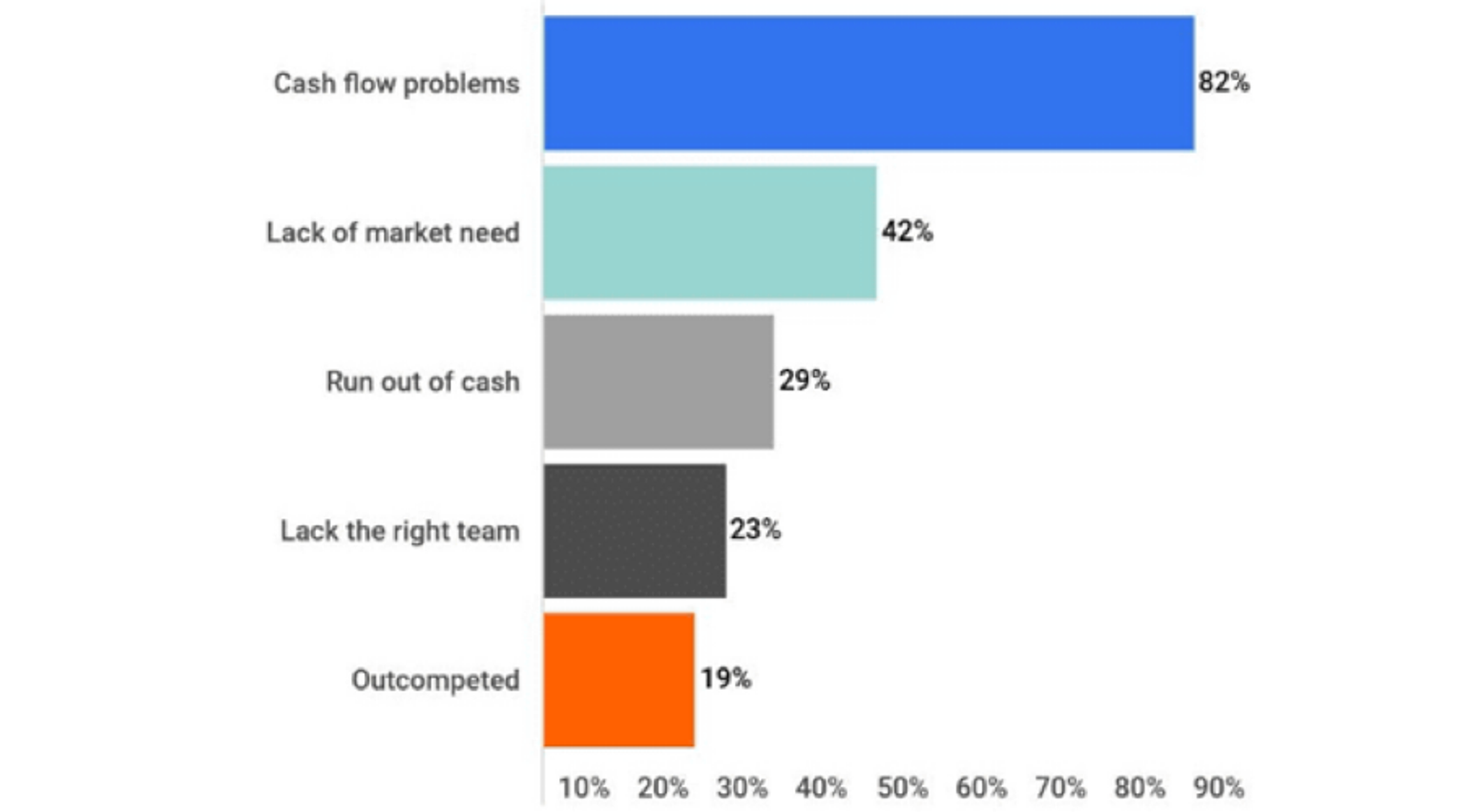

According to Zippia, 82% of small businesses fail because of cash flow problems. So cut down any expenses that do not directly contribute to sales or yield substantial revenue traction for your company. This includes labor, delivery fulfillment, inventory, and more.

Source: Zippia

For example, run an audit of the software tools you’re currently using. While there might be many essential tools, you may find several subscriptions that you rarely or never use. Consider eliminating everything that isn’t mission-critical for your eCommerce business and you’ll be more likely to survive any financial storms.

4. Monitor KPIs for Optimization

Carefully monitor your key performance indicators (KPIs) and expenditures. If you notice any ambiguity or red flags, address them as soon as possible. For instance, evaluate your catalog and inventory stockpile to optimize your finances.

You can use inventory tracking software to see which products come into the warehouse and which are delivered. An inventory audit can help you identify issues before you end up with backorders.

5. Remove Underperforming Items

Low-performing products that aren’t contributing to your revenue are simply tying up your finances. Get rid of these unpopular items to shift focus on what’s working, reduce storage fees, and free up space in your warehouse.

Source: Freepik

6. Leverage Automation

Running an eCommerce business involves many manual steps that you can automate. Automation can help you save on labor costs and streamline many tedious and costly activities.

According to statistics, automation can boost productivity by 14.5% while bringing down marketing overheads by 12.2%. You can increase sales by 20% by automating and personalizing offers using past browsing history and increase the average order size by over 360% using one-click upsells.

7. Secure Funding

During difficult times, you need sufficient funds to stay afloat. Seeing your cash balance heading to zero is a distressing sight for any business owner. Fortunately, many platforms are available to provide you with the much-needed capital for your online business in exchange for a percentage of ongoing revenues.

For example, Clearco is an efficient way to fulfill short-term liquidity needs. You don’t have to give up any equity in exchange for financing or accrue interest on the repayments. All you have to do is repay between 1%-20% of daily sales.

8. Improve Customers’ Shopping Experience

About 86% of customers are willing to pay more for a great customer experience. To offer an impeccable buying experience, work on the customer friction points that could distract or discourage them from making a purchase. This will help you increase checkout completion rates.

For example, you can personalize checkout with pre-filled forms or offer discount codes on the checkout page to improve conversions.

9. Offer Risk-Free Purchases

According to UPS, 75% of consumers want to know the return policy before they buy an item online, and 15% of them abandon the cart if the return policy is vague.

During uncertain times, customers become more hesitant about buying non-essential products. At such a time, de-risking purchases can help you optimize your conversion rate. For instance, you can offer a free trial or a free sample with each order.

10. Create New Revenue Streams

To stay afloat during a recession, consider diversifying your portfolio and opening up additional channels of revenue. Being dependent on one income source can be risky. At AWM, for example, we help you immediately set up multiple streams of income by combining different platforms like Amazon, Facebook, Walmart, and Shopify and scaling up stores on all of them.

Diversifying your revenue streams will not only make your business more resilient in the event of a recession, but it will also provide you with growth opportunities.

Build a Recession-Proof eCommerce Business with AWM

At AWM, we believe a recession is all about positioning, preparing, and being reactive to market changes. If you’re looking for a stable income, be assured that recession is not a roadblock, predicament, or any major issue. We base all our strategies and gameplay on factors like recession so that you can build solid, secure businesses.

We can help you with funding and credit building up until organizing the operations, store management, and data-driven optimizations, so you don’t have to worry about anything. Get in touch to learn more about how we can help you develop a recession-proof online venture.